Our JT Insurance 2021 Insurance Market Update

The insurance market continues to change to meet the unique circumstances we all face with the impact of COVID-19 and the underlying fundamentals which are driving the current “hard market”. As a reminder, this market correction was already in motion at the end of 2019, and COVID-19 only exasperated an already deteriorating market. Insurance buyers have not experienced a hard market like this since 2001.

Challenging headwinds persist for buyers in the form of reduced capacity, higher retentions (deductibles for example), rising rates, and restrictive terms/conditions on renewals. This new landscape became reality in 2020 as insurance markets reduced capacity, tightened terms, and delivered some of the steepest premiums ever reported. Overlayed with the introduction of COVID-19 in the first quarter, a rolling shutdown of the global economy, historically low interest rates, natural catastrophes, and civil unrest it has been quite a year. It is unknown what the full magnitude of the pandemic’s economic impact will be overall and what effect it will have on the insurance industry. Unfortunately, the underlying fundamentals we see with the environment today are likely to continue into the foreseeable future but with varying degrees of impact depending on the sector, you operate in. Hospitality, for example, already hard hit by the pandemic continues to be difficult.

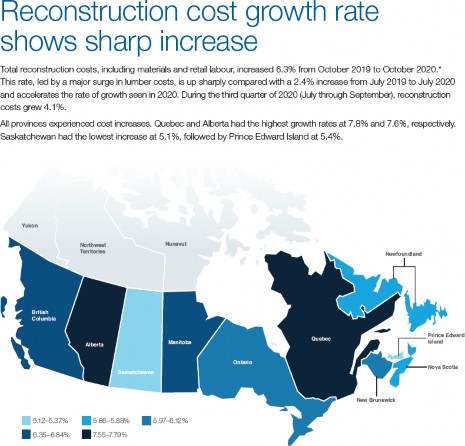

Global losses (particularly weather-related), water damage claims, flooding, and wildfires have had a dramatic impact on the insurance market and this increase in both frequency and severity has moved us from the “soft market” to a “hard market”. This type of market is characterized by higher insurance premiums, more underwriter scrutiny, decreased competition, and greatly reduced capacity. Consecutive years of severe losses in the property market are driving rate increases and a tightening of terms across many accounts. To put this into context, 2017 and 2018 accounted for 25% of the $850 billion in property losses incurred over the past 20 years. Of the losses in 2017 and 2018, nearly two-thirds were due to catastrophes (CAT’s) such as named storms and wildfires. As a result, insurers have been looking for a 20% rate increase in rating and we expect an average of 15 – 20% for the balance of the year. While construction costs have slowed down their pace of increases, the replacement values still have increased by at least 6%. This is reflective of both labour and materials costs.

The following 360Value Quarterly Cost Update for Q4 2019 Canada shows the values:

Strata Insurance

Some segments of the market are experiencing more challenging conditions than the overall property market. Condominium and Strata are one of those areas and rate guidance from major players is more than 20% on risks without claims, higher for those with losses. In British Columbia, new Strata regulations have been introduced and Best Terms Pricing (BTP) on subscriptions has been highlighted with required changes.

This means when you combine both rate and the higher reconstruction value being insured; you should be expecting at least 26% and possibly higher if your property(s) have suffered losses.

Wood Frame Construction

The wood frame market remains distressed with multiple fire and water losses. Rates have continued to move

upward with an average increase of 15% over the past 12 months and more than 20% in the past 24 months.

Capacity constraints in both the domestic, US and London markets continue further upward pressure in

2021.

The property market is clearly focused on recovering from these losses resulting in increased underwriting discipline. Capacity is no longer exiting the market, but deployment is becoming tighter.

Hospitality

Hospitality and Liquor Programs also collapsed in 2020 leaving an already hard-hit sector with

the equivalent of a knockout punch. Capacity is available but the quality of underwriting data and

compliance with inspection reports are critical.

Some other observations

- Nearly all markets have moved toward higher rates, decreased capacity, and more conservative risk selection. The renewal process is taking longer than normal with underwriters both working remotely and being inundated with submissions. Overall, submission clarity and quality will be increasingly critical. Pricing is expected to remain firm throughout 2021 and beyond across all lines of insurance.

- The pandemic and shelter-in-place orders accelerated the market hardening for Directors and Officers, Employment Practices liability, and underwriters are braced for unprecedented risk, economic uncertainty, social change, and corporate transformation

- In property, things have changed unlike any time in the past. COVID-19 has brought into question how Property policies should respond to ‘black swan’ events and impacted how underwriters approach renewals and new business. An increasingly difficult market quickly accelerated from a firming market to a hard market.

- All insurance programs have seen an increase in the number of markets needed to complete a program and renewals are frequently coming down to the last minute. Given market pricing, many buyers have also opted to purchase less limit.

We acknowledge the tremendous uncertainty facing our clients and remain actively engaged with them to provide guidance and help find solutions. Our team is more than willing to discuss to review market conditions, update policy information and address any questions.

We will continue to monitor this market crisis and ensure you are J.T. Advised.

What can you do to assist and control rising insurance premiums?

Regular and preventative maintenance is important to reducing exposure to loss

- Building Updates: Roof, Plumbing, Electrical and Heating

- Tell us about any updates, this is very important if any buildings are over 25 years old

- Consider installing water detection/shut-off devices

- Consider higher deductible options

- Carefully revisit all revenue streams split by Canada, US, and Foreign

- Ask about our Loss Control Services

How J.T. Insurance Services Supports you in this Changing Market

We work for you, our client, and not the insurance company. Using our knowledge and leveraging our long-term relationships we will advocate on your behalf. We will not compromise your coverage and ensure the very best constructed insurance program with the most competitive rating. This includes casting the net as far as possible to leave no stone unturned.

By canvassing as many insurers as we can to secure the best placement, we will continue working diligently on behalf of our clients to mitigate risk as well as the impact of the current market conditions, securing the most favorable outcome in terms of coverage and pricing.

We are starting your renewal process earlier to ensure we create competition on your behalf.

Additional Information

- State of the Canadian Insurance Market

- Why Strata Rates are Increasing

- Insurance Bureau of Canada

- Do I need Cyber, what is it?

Coverage Checklist

✓ Do you carry a full Cyber Insurance Policy with both first and third-party coverage?

✓ Have you reviewed your Crime Coverage limits for adequacy?

✓ Do you carry Machinery Breakdown Coverage?

For more information regarding this topic, please contact your JT Adviser, or visit us at www.jtinsurance.com This material is for informational purposes and is not intended to be exhaustive nor should any discussions or opinions be construed as legal advice. Contact your broker for insurance advice, tax professional for tax advice, or legal counsel for legal advice regarding your particular situation. JT does not accept any responsibility for the content of the information provided or for consequences of any actions taken on the basis of the information provided.

© 2021 J.T. Insurance Services (Canada), Inc. All rights reserved.